BOTW 11: Credit Spread Arbitrage

A pairs trading strategy using the ETFs LQD and HYG generates a Sharpe Ratio 20% better than an equivalent 50-50 benchmark on the same ETFs

Our last backtest looked at pairs trading different mortgage-backed security ETFs. Today, we continue with the fixed income theme by investigating credit spread arbitrage. Most fixed income securities—from sovereign debt to corporate bonds to collateralized loan obligations (CLOs)—have a credit rating that ranks the debt on a scale from least risky (AAA or Aaa) to most (D or C, depending on how well you know the alphabet). Bonds with low default risk are called investment grade and are rated BBB-/Baa3. Below that is junk, often euphemistically called high-yield, which, predictably, has a higher probability of default. The process that goes into assigning ratings is proprietary to the major firms that do it (S&P, Moody's, or Fitch), but is mostly an open secret to the institutional investors and companies that use these ratings to make capital allocation decisions.

All things equal, lower rated (e.g., junk) bonds will have higher yields to compensate the investor for the increased risk of default compared with higher rated (e.g., investment grade) ones. However, if one believes those yields are not warranted based on some view of the future or history, then you might go long the cheap one and short the expensive one. What constitutes cheap is well…relative. It could be based on some spread relative to Treasuries, similarly rated securities, or oolong tea leaves. The most important factor is that it is mean reverting in some way.

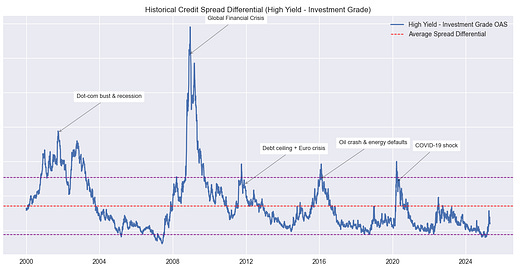

To give one an idea whether it is, we graph the spread between option-adjusted (OAS) junk and investment grade yields below. Don't worry too much what OAS means, it's just an adjustment to equilibrate the yields on callable and non-callable bonds.

We see some dramatic spikes around the global financial crisis and other events noted on the graph. The key point is that spreads do appear to mean-revert. Sounds like a great pairs trading strategy!

Keep reading with a 7-day free trial

Subscribe to Options, Stocks, Machines on Substack to keep reading this post and get 7 days of free access to the full post archives.