BOTW 12: Aristocratic Dogs

Applying the Dogs of the Dow methodology to Dividend Aristocrats yields significant outperformance relative to the benchmark

No, we're not talking about Cavalier King Charles Spaniels, Shih Tzus, or Great Pyrenees. Or a new Tarantino movie. This is a twist on the well-known Dogs of the Dow strategy. But in this case, we use the S&P Dividend Aristocrats. Here's the roadmap. We first explain the Dogs strategy, then what the Dividend Aristocrats are, and then we backtest the strategy and present the results. Let's get to it!

The Dogs of the Dow is a value-based strategy in which one buys the top ten highest dividend-yielding stocks in the Dow Jones Industrial Average (DJIA) at the beginning of each year and holding to end of year. Rinse. Repeat.

The strategy was devised by Michael B. O'Higgins in his book Beating the Dow in 1991. While we haven't tracked the results of the strategy ourselves, internet searches and GPT queries suggest that the strategy outperformed by 1.2% points between 1992 and 2020. But recent performance has lagged due to the overweight performance of tech stocks, which usually don't pay dividends. There have been spin-offs too. Small dogs (Pomeranians?), international dogs (Afghans?), sector dogs, and ETFs.

The S&P Dividend Aristocrats are companies in the S&P 500 that have consistently increased their dividends for at least 25 consecutive years. These companies are seen as reliable and financially stable, appealing to income-focused investors. The index was originally devised by S&P Dow Jones Indices and launched in May 2005. According to S&P, the index has generated about 1% point of outperformance vs. the S&P 500 since inception. There are about 69 stocks in the index with familiar names like Automatic Data Processing, Caterpillar, and Exxon Mobil. Eligibility testing is conducted once a year and the index is rebalanced quarterly to maintain equal weighting. Some famous expulsions have included GE, AT&T, and Pitney Bowes due to failure to increase or even cutting the dividend. There's an ETF for this too.

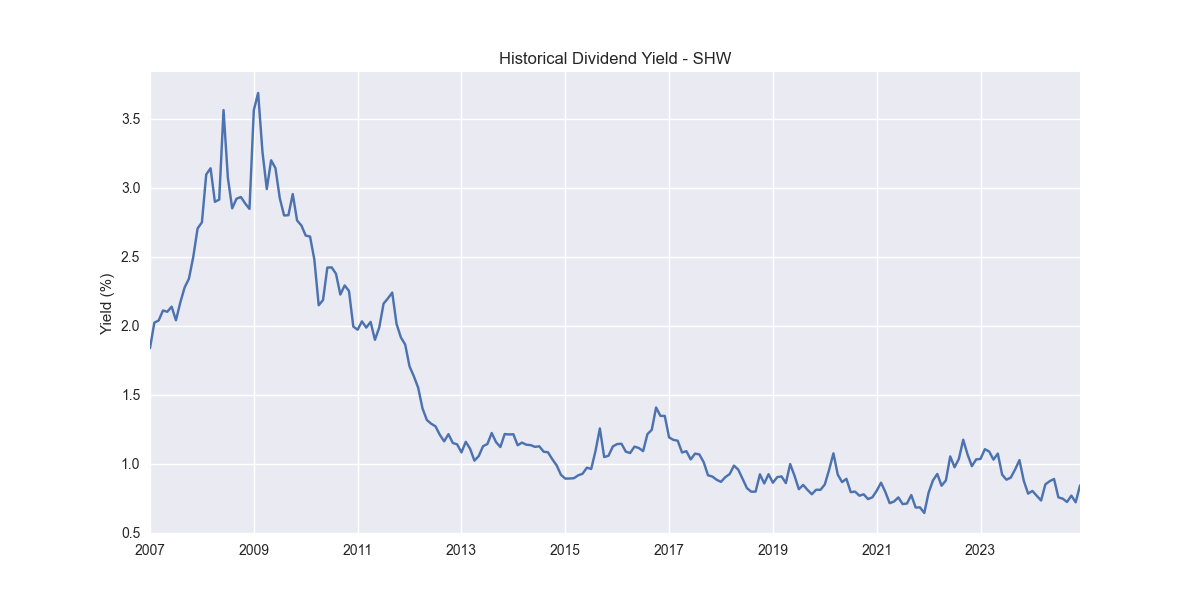

Note, just because these companies consistently increase their dividend, does not mean they have a high yield. For example, Sherwin-Williams (SHW), a high quality company we covered when we were on the sell-side, has rarely had a yield over 2% apart from financial crises, as one can see in the chart below.

Keep reading with a 7-day free trial

Subscribe to Options, Stocks, Machines on Substack to keep reading this post and get 7 days of free access to the full post archives.