BOTW 5: Covered call ETFs

Nice idea, but they don't perform as well as expected. A long-short portfolio of actively vs. passively managed ETFs looks promising though.

The covered call is the most basic option strategy. It entails buying (or holding) an underlying asset and simultaneously (or subsequently) selling a call option on the same underlying that expires sometime in the future. For retail investors, executing covered calls is usually the first level of options trading allowed in US-domiciled brokerages. One needs to fill out an agreement to ensure one has the required understanding needed to employ such strategies, as well as the knowledge of the risks of options. More advanced levels include buying single options, buying spreads, and finally short options. Nonetheless, the covered call is considered one of the safest option strategies since there is no upside risk and the downside risk is capped at the price of the underlying less the premium received from selling the call.

The payoff diagram, which we won't show here as any Google search will bring up sufficient examples, looks a bit like an upside down hockey stick. Essentially, one caps his or her upside in exchange for receiving some premium from the sale of the call. If the underlying is above the exercise price at expiration, the holder sells the underlying to the counterparty at the strike price of the call and keeps the premium plus whatever profit there is. This is calculated as the difference between the strike price less the amount paid for the underlying. You buy a stock for $100, sell the $105 strike call for $1, and if at expiration the stock is $160 (lol!) you get $6—strike price less underlying purchase price + premium.

We deliberately used this example where the underlying is way above the strike at expiration because scenarios like that give covered calls and the strategy itself a bad wrap. That, of course, hasn't prevented legions of investors and brokers from using and recommending the strategy. Indeed, there are now hundreds of ETFs that execute some form of the strategy, as Wall St. loves to ETFersize just about everything and anything. The question we have is, do any of these ETFs live up to the hype?

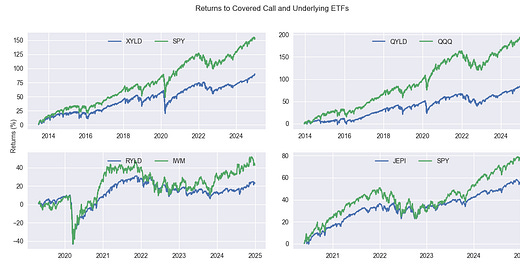

We'll seek to answer this question by comparing the cumulative return since inception of the covered call ETF with its underlying, the Sharpe ratios, and then some potential long-short strategies. Let's begin.

First, we'll examine the following ETFS, XYLD, QYLD, RYLD and their counterparts, SPY, QQQ, IWM. We'll also include JEPI, which is the actively managed JP Morgan ETF that "seeks to deliver monthly income, capital appreciation, and a majority of the returns of the S&P 500 with less volatility," according to its website. We include JEPI because it's actively managed status should give us some comparison with the passively managed ETFs in the first group. Let's graph the cumulative returns of the four covered call ETFs along with the underlying indices below.

Keep reading with a 7-day free trial

Subscribe to Options, Stocks, Machines on Substack to keep reading this post and get 7 days of free access to the full post archives.