HFW 18: Adding the E to ETS

Adding an error term to our exponential smoothing trend and seasonality models produces modestly better performance than without the term

In our last Hello World post, we introduced trend and seasonality to the exponential smoothing model, which we dubbed exponential trend with seasonality (ETWS). That model's performance proved to be similar to the simple exponential smoothing model (SES). Recall, both outperformed the autoregressive growth (AR%(1)) and naive models. Interestingly, the aggregate error for the ETWS model was relatively similar to the SES model. But we did not go into detail as to the causes, leaving such nuances for longer, navel-gazing posts.

Having established the basis for different exponential smoothing models we can now take this one step further and introduce innovations state space models. No, this is not a new science fiction genre or the next iteration of Rodenberry's original series. We rely heavily on Rob Hyndman and his iconic Forecasting: Principles and Practice, for this explanation and the derivation below. Simplistically, most of the models in this group are similar to the exponential smoothing algorithms, but they may also include an error term and whether the trend or seasonality components are additive or multiplicative. (We won't deal with those refinements.) The "state space" part of the name comes from the the equation that describes the observed data (i.e., the measurement equation) and other equations that describe how the other components—level, trend, or seasonality, in other words, the states—change over time. The "innovations" part is that all equations use the same random error process. How that is an innovation is head scratcher to us. But, as we've said before, statistics and language don't seem to play well together.

Whatever the case, readers should be familiar with the addition of the error term. And it is relatively easy to show how it is derived using the smoothing and forecast equations from exponential smoothing model. We use Hyndman’s notation, derivation, and terminology for this explanation. The forecast equation is given as:

And the smoothing equation is given by:

Hence, if one rearranges the smoothing equation, the result is the following:

This is, of course, the SES model. If we include the trend and seasonality components, then it becomes the error, trend, and seasonality (ETS) model. Now there are many flavors of ETS models depending on whether one includes the trend and seasonality components and, as we mentioned above, whether they are additive or multiplicative.

For this post, we won't get too complicated and will simply add the error term. Now before we do that we should definitely wonder how it will perform as error term inclusion (e.g., moving average models) has not produced performant results. Whatever the case, let's move forward.

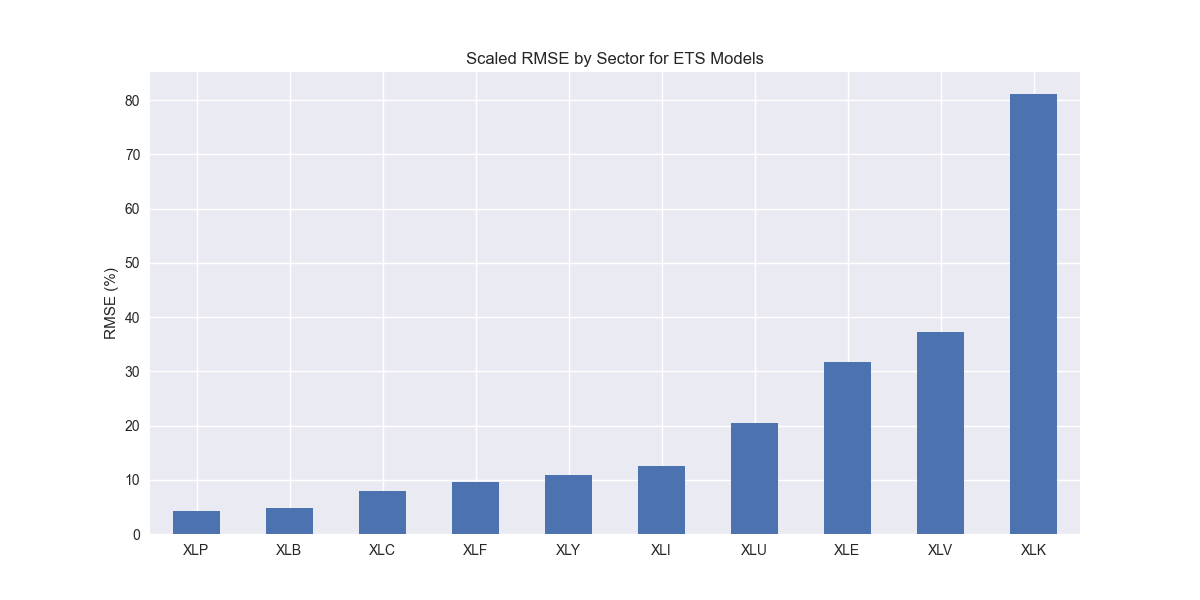

We iterate through the ETS models and produce the now ubiquitous scaled root mean-squared error graph.

Nothing out of the ordinary. Some of the sectors trade places compared to the ETWS model, but we’ll leave that analysis for now. Let's compare to the benchmarks.

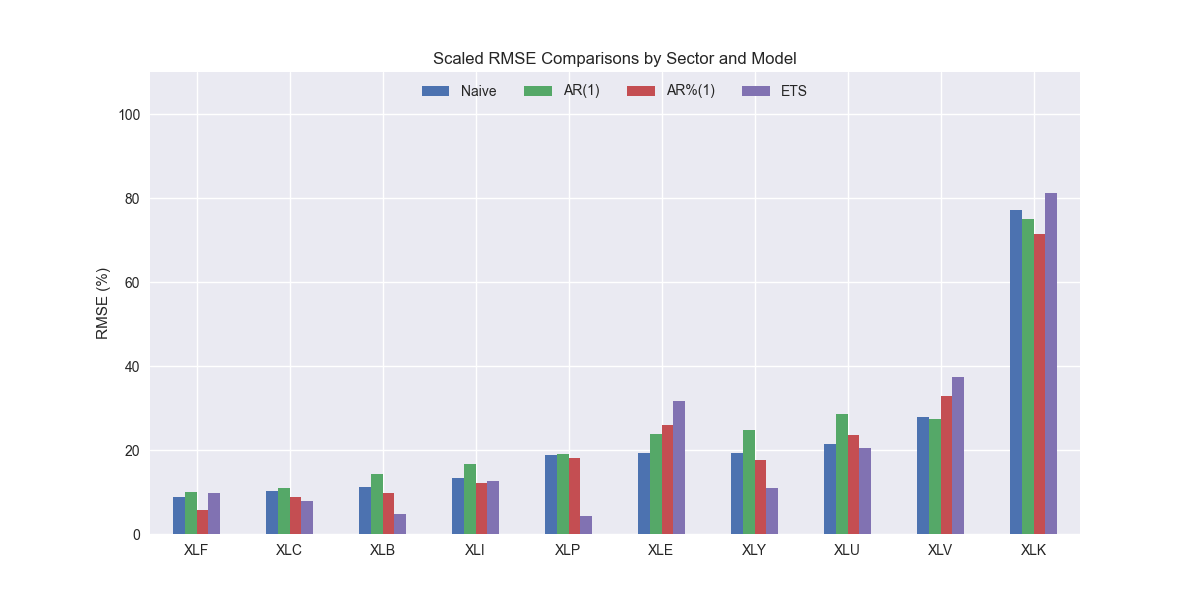

The ETS model appears better than the naive model at a 60/40 ratio. It's scaled RMSE is lower than the naive model for XLB, XLC, XLI, XLU, XLP, and XLY, the materials, communications, industrials, utilities, staples, and discretionary ETFs. For the remainder, it's worse. Let's confirm the aggregate performance below.

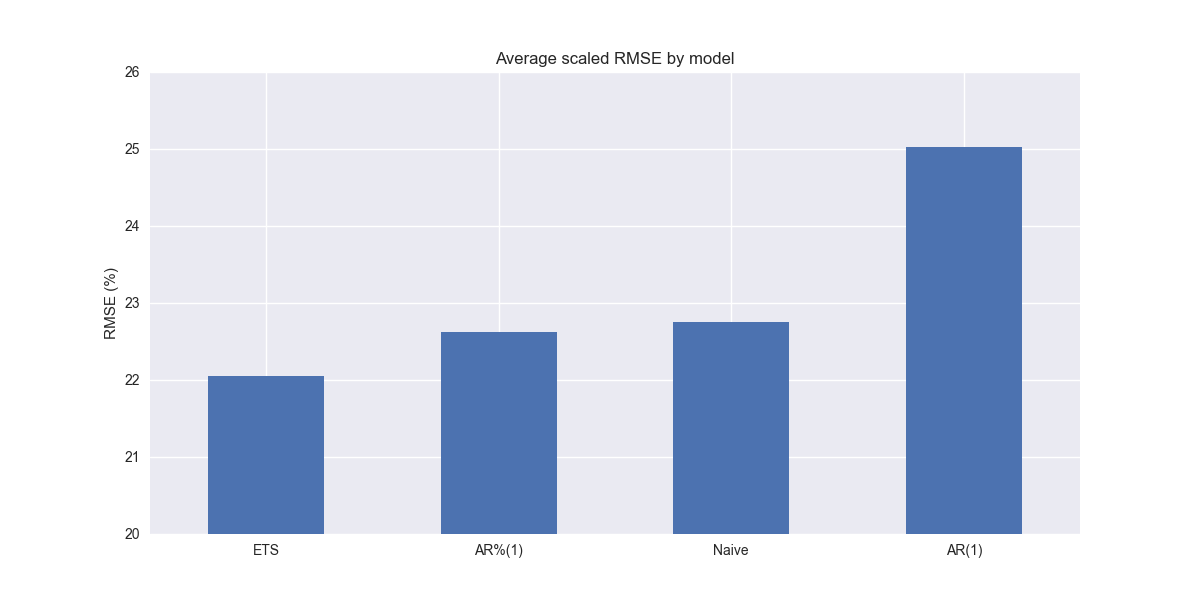

The ETS model does indeed outperform the naive and AR%(1) models. Comparing the above graph with the ETWS model graph from the last post one might be tempted to say it is slightly better. But the differences are in basis points. Nonetheless, in our next post we’ll compare the two to see if there are any major differences warranting preference of one over the other. Stay tuned!

Code below.

# Load packages

import numpy as np

import pandas as pd

from datetime import datetime, timedelta

import statsmodels.api as sm

import matplotlib.pyplot as plt

from matplotlib.ticker import FuncFormatter

import matplotlib as mpl

import pickle

from statsmodels.tsa.exponential_smoothing.ets import ETSModel

# Assign chart style

plt.style.use('seaborn-v0_8')

plt.rcParams["figure.figsize"] = (12,6)

# Handy functions

# Functions to load and save files

def save_dict_to_file(data, filename):

with open(filename, 'wb') as f:

pickle.dump(data, f)

def load_dict_from_file(filename):

with open(filename, 'rb') as f:

return pickle.load(f)

# Create functions for indexing

def create_index(series):

if series.iloc[0] > 0:

return series/series.iloc[0] * 100

else:

return (series - series.iloc[0])/-series.iloc[0] * 100

# Function for scaled RMSE

def get_rmse_scaled(series):

return np.sqrt(np.mean((series['actual']-series['predicted'])**2))/np.mean(series['actual'])

# Function to flatten

def flatten_df(dataf: pd.DataFrame, group_name:str, cols:list) -> pd.DataFrame:

df_grouped = dataf.groupby(group_name)[cols].agg(list)

for col in cols:

df_grouped[col] = df_grouped[col].apply(lambda x: np.concatenate(x))

df_long = df_grouped.apply(pd.Series.explode).reset_index()

return df_long

# Symbols used

etf_symbols = ['XLF', 'XLI', 'XLE', 'XLK', 'XLV', 'XLY', 'XLP', 'XLB', 'XLU', 'XLC']

ticker_list = ["SHW", "LIN", "ECL", "FCX", "VMC",

"XOM", "CVX", "COP", "WMB", "SLB",

"JPM", "V", "MA", "BAC", "GS",

"CAT", "RTX", "DE", "UNP", "BA",

"AAPL", "MSFT", "NVDA", "ORCL", "CRM",

"COST", "WMT", "PG", "KO", "PEP",

"NEE", "D", "DUK", "VST", "SRE",

"LLY", "UNH", "JNJ", "PFE", "MRK",

"AMZN", "SBUX", "HD", "BKNG", "MCD",

"META", "GOOG", "NFLX", "T", "DIS"

]

xlb = ["SHW", "LIN", "ECL", "FCX", "VMC"]

xle = ["XOM", "CVX", "COP", "WMB", "SLB"]

xlf = ["JPM", "V", "MA", "BAC", "GS"]

xli = ["CAT", "RTX", "DE", "UNP", "BA"]

xlk = ["AAPL", "MSFT", "NVDA", "ORCL", "CRM"]

xlp = ["COST", "WMT", "PG", "KO", "PEP"]

xlu = ["NEE", "D", "DUK", "VST", "SRE"]

xlv = ["LLY", "UNH", "JNJ", "PFE", "MRK"]

xly = ["AMZN", "SBUX", "HD", "BKNG", "MCD"]

xlc = ["META", "GOOG", "NFLX", "T", "DIS"]

sectors = [xlf, xli, xle, xlk, xlv, xly, xlp, xlb, xlu, xlc]

# Sector dictionary

sector_dict = {symbol.lower(): tickers for symbol, tickers in zip(etf_symbols, sectors)}

sector_map = {ticker.lower(): symbol for symbol, tickers in zip(etf_symbols, sectors) for ticker in tickers}

# Load data from disk

# See Code Walk-Throughs for how we built the data set

df_sector_dict = load_dict_from_file("path/to/data/simfin_df_rev_dict.pkl")

# Clean dataframes

df_rev_index_dict = {}

for key in sector_dict:

temp_df = df_sector_dict[key].copy()

col_1 = temp_df.columns[0]

temp_df = temp_df[[col_1] + [x for x in temp_df.columns if 'revenue' in x]]

temp_df.columns = ['date'] + [x.replace('revenue_', '').lower() for x in temp_df.columns[1:]]

temp_idx = temp_df.copy()

temp_idx[[x for x in temp_idx if 'date' not in x]] = temp_idx[[x for x in temp_idx if 'date' not in x]].apply(create_index)

df_rev_index_dict[key] = temp_idx

# Create train/test dataframes

df_rev_train_dict = {}

df_rev_chg_train_dict = {}

df_rev_test_dict = {}

for key in df_rev_index_dict:

# Create ticker list

tickers = [x.lower() for x in sector_dict[key]]

# Create dataframe fo all

df_out = df_rev_index_dict[key]

# Base train df

df_train = df_out.loc[df_out['date'] < "2023-01-01"].copy()

df_rev_train_dict[key] = df_train

# Chang train df

df_train_chg = df_train.copy()

df_train_chg[tickers] = df_train_chg[tickers].apply(lambda x: np.log(x).diff())

df_train_chg = df_train_chg.dropna()

df_rev_chg_train_dict[key] = df_train_chg

# Test df

df_rev_test_dict[key] = df_out.loc[df_out['date'] >= "2023-01-01"]

# Create ETS models

ets_models = {}

for key in df_rev_chg_train_dict:

tickers = [x.lower() for x in sector_dict[key]]

df_train = df_rev_train_dict[key]

ets_models[key] = {}

for ticker in tickers:

try:

model = ETSModel(

df_train[ticker],

error='add', # 'add' or 'mul'

trend='add', # 'add', 'mul', or None

seasonal='add', # 'add', 'mul', or None

seasonal_periods=4

).fit(disp=False)

except ValueError as e:

print(f"{ticker} fails due to {e}")

ets_models[key][ticker] = model

ets_err_df = pd.DataFrame(columns = ['sector', 'ticker', 'actual', 'predicted'])

count = 0

# forecast_horizon = np.arange(16,19)

for key in ets_models:

for ticker in ets_models[key]:

# Forecast the next 4 quarters

y_pred = ets_models[key][ticker].get_prediction(start=16, end=19).predicted_mean

y_act = df_rev_test_dict[key][ticker].values

ets_err_df.loc[count] = [key.upper(), ticker, y_act, y_pred]

count += 1

for ticker in ets_err_df['ticker'].to_list():

actual = ets_err_df.loc[ets_err_df['ticker']==ticker, 'actual'].values[0]

predicted = ets_err_df.loc[ets_err_df['ticker']==ticker, 'predicted'].values[0]

rmse = np.sqrt(np.mean((actual - predicted)**2))

rmse_scaled = rmse/actual.mean()

ets_err_df.loc[ets_err_df['ticker']==ticker, 'rmse'] = rmse

ets_err_df.loc[ets_err_df['ticker']==ticker, 'rmse_scaled'] = rmse_scaled

# Clean and flatten ar_err_df

ets_df_long = flatten_df(ets_err_df, 'sector', ['actual', 'predicted'])

# Graph scaled RMSE by sector

(ets_df_long.groupby('sector')[['actual', 'predicted']].apply(get_rmse_scaled).sort_values(ascending=True)*100).plot(kind='bar', rot=0)

plt.xlabel('')

plt.ylabel('RMSE (%)')

plt.title('Scaled RMSE by Sector for ETS Models')

plt.show()

# Get benchmarks

comp_df = pd.read_pickle("path/to/data/comp_new_df.pkl")

ets = ets_df_long.groupby('sector')[['actual', 'predicted']].apply(get_rmse_scaled).reset_index().rename(columns={0:'ets'})

comp_df = comp_df.merge(ets, how="left", on='sector')

comp_df.iloc[:, 1:].mean()*100

# Plot RMSE by sector and model

(comp_df.set_index('sector')[['naive', 'lr', 'chg','ets']].sort_values('naive')*100).plot(kind='bar', rot=0)

plt.xlabel('')

plt.ylabel('RMSE (%)')

plt.ylim(0, 110)

plt.legend(['Naive', 'AR(1)', 'AR%(1)', 'ETS'], loc='upper center', ncol=4)

plt.title('Scaled RMSE Comparisons by Sector and Model')

plt.show()

# Plot Average performance

x_lab_dict = {'naive': 'Naive', 'lr': 'AR(1)', 'chg': 'AR%(1)', 'ets':'ETS'}

x_labs = comp_df.iloc[:, 1:].mean().sort_values().index.to_list()

(comp_df.iloc[:, 1:].mean().sort_values()*100).plot(kind='bar', rot=0)

plt.xticks(np.arange(4), [x_lab_dict[x] for x in x_labs])

plt.ylabel('RMSE (%)')

plt.ylim(20,26)

plt.title('Average scaled RMSE by model')

plt.savefig("hello_world/images/day_18_avg_rmse.png")

plt.show()

# Comparisons

comp_df.loc[comp_df['ets']<comp_df['naive'], 'sector']

comp_df.loc[comp_df['ets']>comp_df['naive'], 'sector']

That's great. Understanding the error term is so vital!