BOTW 13: Doggie Deux

Using deciles instead of a top 10 ranking improves our Aristocratic Dog strategy by 10 percentage points.

In our last Backtest of the Week, we applied the Dogs of the Dow strategy to the Dividend Aristocrats of the S&P 500. Recall that to be considered an Aristocrat, the company must be in the S&P 500 and must have consistently increased its dividend for at least 25 consecutive years. If you're in the index provider business this is a great example of upselling. Create an index and then create an index within that index. And, of course, trademark those indices and charge money to use them and get the underlying constituents. No irony here. In any case, our backtest used the basics of the dog strategy with a twist: we found the top ten and bottom ten yielding stocks each year and constructed long-short and equal-weighted portfolios from them. We then compared these portfolios to the benchmark: an equal-weighted portfolio of all the constituents that was rebalanced quarterly, similar to the S&P construction.

The results were impressive. The long-short portfolio generated 40% of points of outperformance relative to benchmark. Since then we've seen similar strategies mentioned in the financial press. Apparently one well-known strategist recommended a similar, though simpler version: divide the large caps into quintiles by dividend yield and buy the second highest quintile. The suggestion was that one might re-calculate the rankings every month. But it was unclear if that was how the strategy was actually backtested. Whatever the case, the results showed massive outperformance of the second quintile strategy, almost 4x . But that was on close to 100 years of compounding! On compound returns, the first quintile outperformed the S&P by about 90bps a year, while the second quintile outperformed by 140bps a year. Buffett maybe a nonagenarian, but we're pretty sure he didn't buy is first stock the minute he was born.

Nonetheless, this got us thinking about using different quantiles to see if we could improve returns. As we noted, the bottom yielders probably included high quality names that have never had a high yield like Sherwin-Williams. So maybe we should not be shorting the bottom, but the middle? Who knows. Let's see!

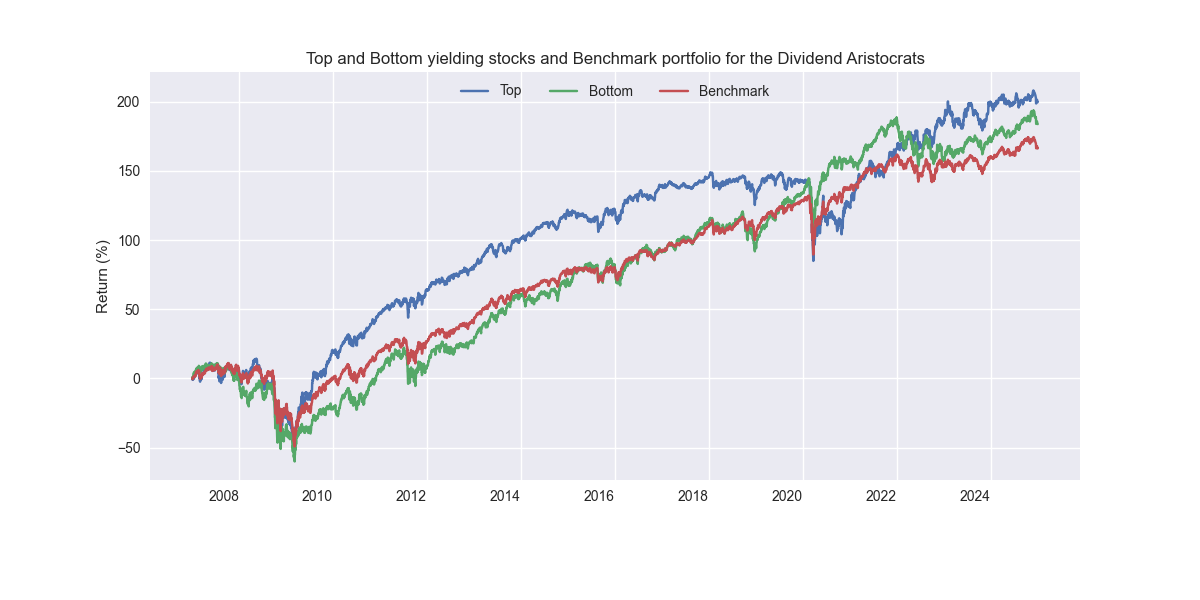

At each year end, we group the stocks into deciles. Then we long the top decile and short the bottom. This should not be too different than the former strategy, which went long the top 10 and short the bottom. We first show the the top and bottom deciles along with the benchmark below.

Keep reading with a 7-day free trial

Subscribe to Options, Stocks, Machines on Substack to keep reading this post and get 7 days of free access to the full post archives.