HFW 21: Parsing AutoETS

Multiplicative errors appear the most prevalent across the AutoETS models

In our last post, we deployed AutoETS across our S&P 500 revenue dataset and compared results to our typical benchmarks, the naive, autoregressive (AR(1)), and autoregressive growth (AR%(1)) models. AutoETS performed remarkably well—error rates dropped 2% points vs the best performing AR%(1) model. This welcome performance notwithstanding, it would be worthwhile to see what the distribution of models chosen turned out to be. First, imagining we had a stakeholder to whom we must communicate our findings, this would provide a bit more detail around what's going on underneath the hood. Second, to see if AutoETS reveals something about the data that improves our intuition. For example, say we used an AAA model (additive Error, Trend, and Seasonality equations) to generate forecasts. But then AutoETS found another model, say MNN (multiplicative error, no Trend or Seasonality equations) that performed better.

On first glance, this might be a counter intuitive result, so we'd like to understand why this is the better model. We'd want to size the performance improvement. Is it meaningful? Could it simply be due to randomness. If it is better, does the underlying logic of state space models reveal a new intuition about the data generation process? For example, AutoETS might choose multiplicative over additive errora. This might suggest that relative errors are more relevant for our time series. Why relative? If the actual data are increasing—something not unlikely in sales data (we certainly would like to see companies we want to invest in enjoying increasing sales)—then errors are likely to increase with that process. Hence, the error relative to the size of the forecast—or multiplicative errors—is more appropriate.1

We've actually been leading the discussion in the direction of multiplicative errors for a reason, which will be revealed shortly. Let's iterate through S&P 500 revenue dataset using AutoETS to find the best model. We’ll then graph the relative frequency of those models below.

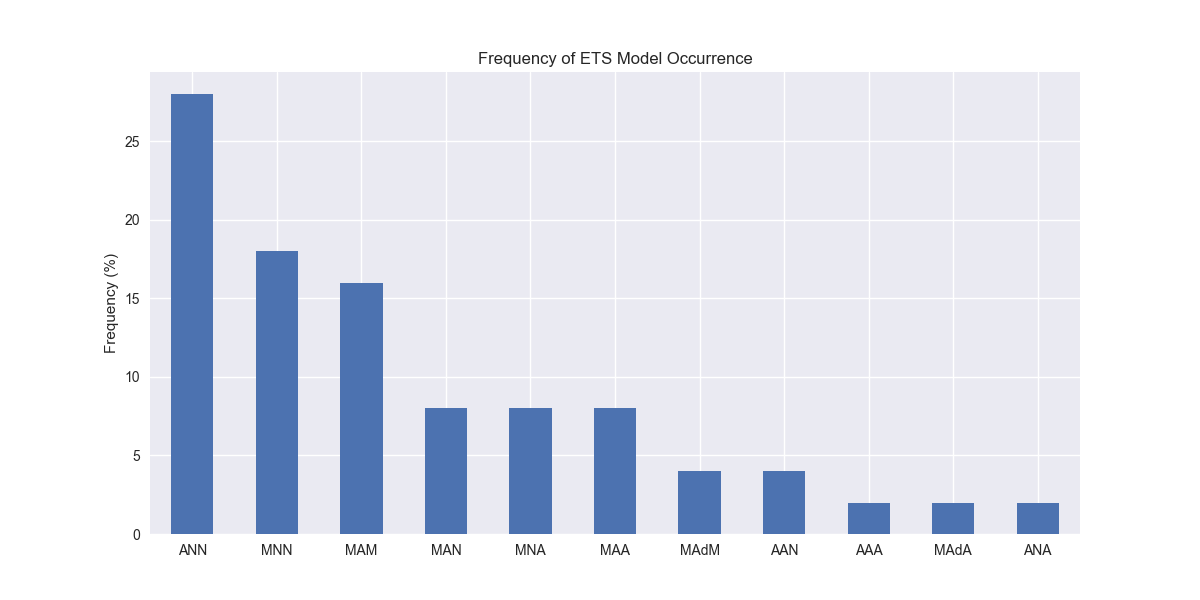

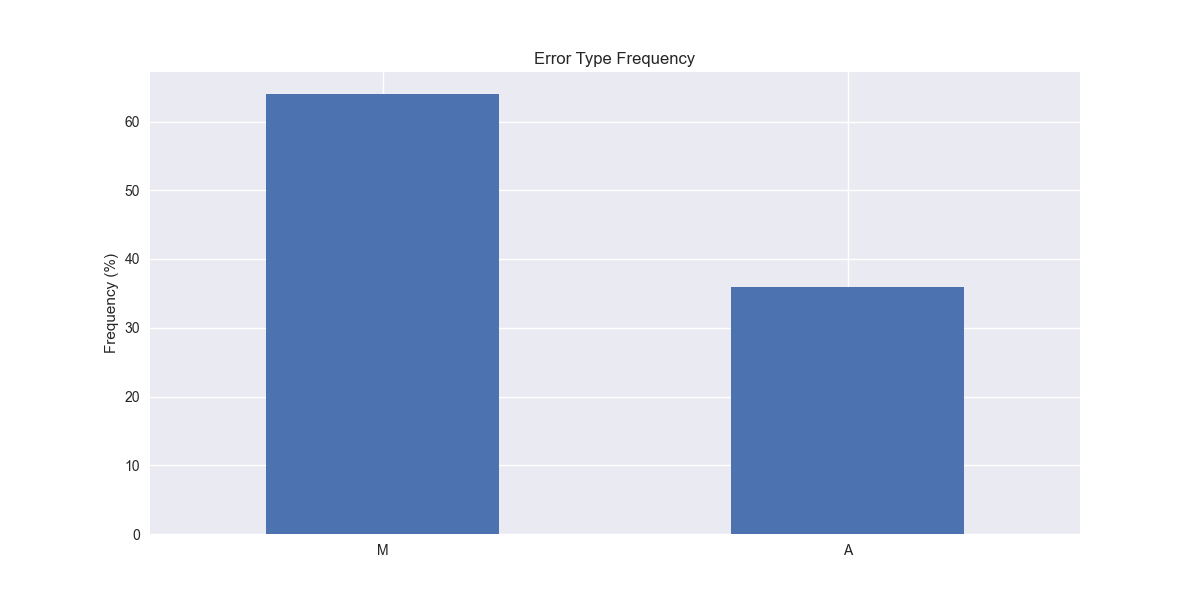

Interestingly, the ANN model (additive error, no trend, and no seasonality) enjoys the highest frequency at close to 30% of the model versions. Pretend like you don’t see the “Ad” abbreviation for two of the models—we’ll explain that later. But do notice that multiplicative errors seem prevalent across many models. Indeed, when we calculate the relative frequency of error types across all the models, we find that multiplicative errors are used in over 60% of the models, as shown in the graph below.

Given what we've discussed above on the relevance of multiplicative errors for increasing sales, that should make intuitive sense, assuming that most of the companies in our data set saw increasing sales for the training period. We’d definitely need to confirm this. In our next post, we'll examine the frequency of different equations for the trend and seasonality portions of the ETS models. Stay tuned!

Code below

# Load packages

import numpy as np

import pandas as pd

from datetime import datetime, timedelta

import statsmodels.api as sm

import matplotlib.pyplot as plt

from matplotlib.ticker import FuncFormatter

import matplotlib as mpl

import pickle

from statsmodels.tsa.exponential_smoothing.ets import ETSModel

from sktime.forecasting.ets import AutoETS

from collections import Counter

# Assign chart style

plt.style.use('seaborn-v0_8')

plt.rcParams["figure.figsize"] = (12,6)

# Handy functions

# Functions to load and save files

def save_dict_to_file(data, filename):

with open(filename, 'wb') as f:

pickle.dump(data, f)

def load_dict_from_file(filename):

with open(filename, 'rb') as f:

return pickle.load(f)

# Create functions for indexing

def create_index(series):

if series.iloc[0] > 0:

return series/series.iloc[0] * 100

else:

return (series - series.iloc[0])/-series.iloc[0] * 100

# Function for scaled RMSE

def get_rmse_scaled(series):

return np.sqrt(np.mean((series['actual']-series['predicted'])**2))/np.mean(series['actual'])

# Function to flatten

def flatten_df(dataf: pd.DataFrame, group_name:str, cols:list) -> pd.DataFrame:

df_grouped = dataf.groupby(group_name)[cols].agg(list)

for col in cols:

df_grouped[col] = df_grouped[col].apply(lambda x: np.concatenate(x))

df_long = df_grouped.apply(pd.Series.explode).reset_index()

return df_long

# Symbols used

etf_symbols = ['XLF', 'XLI', 'XLE', 'XLK', 'XLV', 'XLY', 'XLP', 'XLB', 'XLU', 'XLC']

ticker_list = ["SHW", "LIN", "ECL", "FCX", "VMC",

"XOM", "CVX", "COP", "WMB", "SLB",

"JPM", "V", "MA", "BAC", "GS",

"CAT", "RTX", "DE", "UNP", "BA",

"AAPL", "MSFT", "NVDA", "ORCL", "CRM",

"COST", "WMT", "PG", "KO", "PEP",

"NEE", "D", "DUK", "VST", "SRE",

"LLY", "UNH", "JNJ", "PFE", "MRK",

"AMZN", "SBUX", "HD", "BKNG", "MCD",

"META", "GOOG", "NFLX", "T", "DIS"

]

xlb = ["SHW", "LIN", "ECL", "FCX", "VMC"]

xle = ["XOM", "CVX", "COP", "WMB", "SLB"]

xlf = ["JPM", "V", "MA", "BAC", "GS"]

xli = ["CAT", "RTX", "DE", "UNP", "BA"]

xlk = ["AAPL", "MSFT", "NVDA", "ORCL", "CRM"]

xlp = ["COST", "WMT", "PG", "KO", "PEP"]

xlu = ["NEE", "D", "DUK", "VST", "SRE"]

xlv = ["LLY", "UNH", "JNJ", "PFE", "MRK"]

xly = ["AMZN", "SBUX", "HD", "BKNG", "MCD"]

xlc = ["META", "GOOG", "NFLX", "T", "DIS"]

sectors = [xlf, xli, xle, xlk, xlv, xly, xlp, xlb, xlu, xlc]

# Sector dictionary

sector_dict = {symbol.lower(): tickers for symbol, tickers in zip(etf_symbols, sectors)}

sector_map = {ticker.lower(): symbol for symbol, tickers in zip(etf_symbols, sectors) for ticker in tickers}

# Load data from disk

# See Code Walk-Throughs for how we built the data set

df_sector_dict = load_dict_from_file("hello_world/data/simfin_df_rev_dict.pkl")

# Clean dataframes

df_rev_index_dict = {}

for key in sector_dict:

temp_df = df_sector_dict[key].copy()

col_1 = temp_df.columns[0]

temp_df = temp_df[[col_1] + [x for x in temp_df.columns if 'revenue' in x]]

temp_df.columns = ['date'] + [x.replace('revenue_', '').lower() for x in temp_df.columns[1:]]

temp_idx = temp_df.copy()

temp_idx[[x for x in temp_idx if 'date' not in x]] = temp_idx[[x for x in temp_idx if 'date' not in x]].apply(create_index)

df_rev_index_dict[key] = temp_idx

# Create train/test dataframes

df_rev_train_dict = {}

df_rev_chg_train_dict = {}

df_rev_test_dict = {}

for key in df_rev_index_dict:

# Create ticker list

tickers = [x.lower() for x in sector_dict[key]]

# Create dataframe fo all

df_out = df_rev_index_dict[key]

# Base train df

df_train = df_out.loc[df_out['date'] < "2023-01-01"].copy()

df_rev_train_dict[key] = df_train

# Chang train df

df_train_chg = df_train.copy()

df_train_chg[tickers] = df_train_chg[tickers].apply(lambda x: np.log(x).diff())

df_train_chg = df_train_chg.dropna()

df_rev_chg_train_dict[key] = df_train_chg

# Test df

df_rev_test_dict[key] = df_out.loc[df_out['date'] >= "2023-01-01"]

# Create trend models

auto_ets_models = {}

model_type = pd.DataFrame(columns=['sector', 'ticker', 'type'])

count = 0

for key in df_rev_chg_train_dict:

tickers = [x.lower() for x in sector_dict[key]]

df_train = df_rev_train_dict[key]

auto_ets_models[key] = {}

for ticker in tickers:

try:

model = AutoETS(

auto=True,

n_jobs=-1,

sp=4

).fit(df_train[ticker])

except ValueError as e:

print(f"{ticker} fails due to {e}")

auto_ets_models[key][ticker] = model

summary_table = model.summary().tables[0]

model_string = summary_table.data[1][1] # This gets a string like 'ETS(AAA)'

ets_type = model_string[model_string.find("(") + 1:model_string.find(")")]

model_type.loc[count] = [key, ticker, ets_type]

count += 1

# Plot model types

(model_type['type'].value_counts(normalize=True).sort_values(ascending=False)*100).plot(kind='bar', rot=0)

plt.xlabel("")

plt.ylabel("Frequency (%)")

plt.title("Frequency of ETS Model Occurrence")

plt.show()

# Plot frequency of Error Types

(model_type['type'].apply(lambda x: x.split()[0][0]).value_counts(normalize=True).sort_values(ascending=False)*100).plot(kind='bar', rot=0)

plt.xlabel("")

plt.ylabel("Frequency (%)")

plt.title("Error Type Frequency")

plt.show()While this may seem like another example of confusing statspeak, the reason it is called multiplicative is because the forecast gets multiplied by the error term (actually 1 + error).